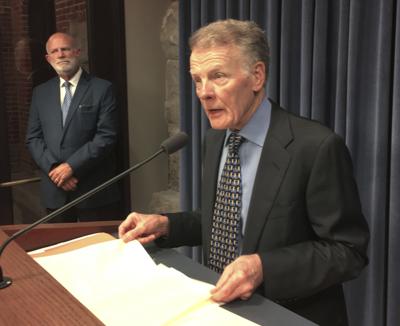

(The Center Square) – Michael J. Madigan is out.

The former Illinois House speaker is now a former Illinois state representative, after expediting his departure to the close of business Thursday.

Madigan initially released a statement that said he’d depart at the end of February. Then he curiously, and without explanation, filed a resignation letter that he submitted to the Illinois Clerk of the House, John W. Hollman, that stated:

Dear Mr. Clerk:

I, Michael J. Madigan, do hereby resign the office of State Representative of the 22nd Representative District, effective today, February 18, 2021. This letter serves as my letter of resignation.

With kindest personal regards, I remain

Sincerely yours,

Michael J. Madigan

It’s the “I remain, Sincerely yours, Michael J. Madigan,” that’s worthy of a closer look.

I am not sure that there was a single moment in his political tenure that Democrat from Chicago’s southwest side was personal with anyone that didn’t benefit his aims, regarded much of anything that wasn’t good for him or his hyper-partisan approach to governing, or was the slightest bit sincere in the way that he approached his speakership.

In the end, he rattled around the Illinois House for more than 50 years – 36 of them (a national record among state legislators) as its speaker. The state of Illinois was admitted to the union in 1818. For about a quarter of Illinois' existence, Madigan, a clear case for term limits, legislated in it.

Still embroiled in the ongoing Department of Justice investigation of ComEd, Illinois’ largest power distributor, Madigan was a throwback to a time that should have been scrubbed from politics decades ago. Arrogant, untouchable, beyond reproach. Only in Illinois would such be possible.

A tax lawyer by trade, he was a masterful backroom operator well into an era where calls for transparency reign. Weak, lapdog statehouse media allowed this unchecked authority to operate in plain sight. Again, only in Illinois, where speaking truth to power means you get limited press access.

At a time when cancel culture comes relentlessly hard for men such as Madigan, he skated like an Olympian through his #MeToo moment. His final gold medal routine was benefited by the absence of an executive inspector general, whose responsibility was his to appoint, and many of the claims from victims against his office and his cronies simply were allowed to expire by statute. Equal parts brilliant and disgusting.

The carefulness of his business dealings and insulation by the machine he’d inherited and built might best be explained in one anachronistic sentence: Madigan didn’t – and doesn’t – carry a smartphone, and the man has no known active email account.

From his statement to the media, which initially said that he was hanging around until the end of the month, Madigan acknowledged that he’d faced “vicious attacks by people who sought to diminish” his legislative focus to improve the lots of “the working people of Illinois."

He left out the part about steering the state into financial ruin and running up unfunded pension obligations for the state’s public-sector employees to $144 billion, according to The Bond Buyer, while creating the most chasmic separation between legislative Democrats and Republicans in the center of the United States.

While a parade of corrupt and ineffective governors came and went, and as Illinois’ population trickled out in U-Haul trucks to live elsewhere to flee insane property taxes and a degrading quality of life, Madigan was the lone constant.

Forget about the governors. They bent at Madigan's knee, or didn't. Madigan ran the show. He called the shots. No piece of legislation under Madigan’s House rules reached a vote without his approval. It all ran through him and was run by him.

While history is written by the winners, and Illinois remains a deeply Democrat-controlled state mired in historic financial ruin, history will not – and should not – be kind to Madigan.

* * * *

Elsewhere in America...

ARIZONA

A measure working its way through the Arizona Legislature would grant people, businesses, hospitals and local governments partial immunity from pandemic-related litigation. Senate Bill 1377 passed muster in the Senate Rules Committee on Monday along party lines. It also made its way out of the Senate Judiciary Committee in kind last week. The bill would require anyone seeking pandemic-related damages in court to prove the “provider” can provide clear and convincing evidence they were purposefully negligent. It’s seen as a higher bar for a plaintiff to prove than in other civil tort lawsuits.

COLORADO

Colorado Gov. Jared Polis pushed for more tax relief to help the state's economic recovery during his State of the State address last week. Among the proposals he endorsed were eliminating the business personal property tax, doubling the earned income tax credit and no longer taxing Social Security benefits for senior citizens. The tax relief would be in addition to Proposition 116, a measure approved by voters in November that reduced the state income tax from 4.63% to 4.55%.

WASHINGTON

Washington's capital gains tax proposal is one step closer to becoming law after surviving two dozen amendments in a key legislative committee last week. The bill effectively would lower the capital gains tax rate from 9% to 7% and includes an across-the-board exemption for commercial and residential real estate. The bill already has drawn opposition from 42 technology CEOs who warned in a letter sent to the committee that a capital gains tax could spur a mass corporate exodus.

OHIO

Two Ohioans have filed lawsuits challenging the Ohio tax law that allows cities to tax income of workers who, the lawsuits say, do not live in nor work in the municipalities. The Buckeye Institute, an independent research and educational group, filed the lawsuits on behalf of Eric Denison and Josh Schaad against the cities of Columbus and Cincinnati. The lawsuits ask the court to declare unconstitutional Ohio law that allows cities to tax workers who do not live in and have not been working in those cities. Denison, who lives in the Columbus suburb of Westerville, and Schaad, who lives in the Cincinnati suburb of Blue Ash, spent time in 2020 during the COVID-19 pandemic working offsite.

INDIANA

School administrator salaries in Indiana have risen by almost 17% since 2010, according to a report released last month, and many salaries of school superintendents are now near $250,000 a year, when including bonuses, car stipends and contributions to retirement accounts. The report said if administration costs had grown at the same rate as all salary costs, “schools would have saved more than $75 million in 2019 – enough to add over $1,000 in compensation for every teacher.”

KENTUCKY

Kentucky Senate President Robert Stivers, R-Manchester, filed a bill last week that would require a governor faced with picking a successor to a U.S. senator to select an individual from the same political party. Senate Bill 228 has the support of U.S. Senate Minority Leader Mitch McConnell, according to a statement given by McConnell spokesman Robert Steurer. The bill comes as both McConnell and U.S. Sen. Rand Paul are Republicans, and Gov. Andy Beshear is a Democrat.

VIRGINIA

Legislation that would allow illegal immigrants to get in-state tuition for public colleges and ID cards at the DMV narrowly passed both chambers of the Virginia General Assembly. House Bill 2123, sponsored by Del. Alfonso Lopez, D-Arlington, would ensure residents, regardless of their citizenship status or immigration status, will have equal access to all educational benefits in the commonwealth, including in-state tuition and financial assistance programs provided by the state or the higher education institution.

GEORGIA

An effort in the Georgia Legislature to increase the tax credit for adopting a foster child could cost the state $4.8 million in revenue over the next five years. House Bill 114 would increase the annual tax incentive for adopting a foster child from $2,000 to $6,000. The Department of Audits and Accounts estimated the proposal could decrease state tax revenues by $400,000 in fiscal year 2022 and grow to up to a $1.5 million revenue loss by fiscal year 2026.

NORTH CAROLINA

The state must repay the federal government $7 million in Extended Benefits unemployment program funding, and unless North Carolina legislators change the law, the benefits must be taken from the unemployed workers who already received the benefits. State officials said North Carolina might need to decrease weekly EB payments for about 20,000 workers unless state law is changed to allow the state to dip into unemployment reserves to cover the cost. The state also could seek federal relief.

LOUISIANA

The federal government has proposed building a levee system that could give residents of seven southeast Louisiana parishes the same level of flood protection as New Orleans. The $1.9 billion cost, however, concerns local officials who said the project can be completed for less money. The federal government likely would pay 65% of the cost. State and local partners would be expected to pay for the remainder, and a local funding source has not been identified.

TEXAS

Gov. Greg Abbott is calling on the Texas Legislature to introduce legislation and authorize funding to winterize the state's power system after widespread power failures. Abbott previously called on the Legislature to reform and investigate the Electric Reliability Council of Texas (ERCOT) to ensure Texans never again experience power outages on the scale they have seen over the past several days. He also spoke with President Joe Biden on Friday and with leaders in various industries to determine the best course of action going forward.

WEST VIRGINIA

West Virginia legislation that would limit the governor’s spending authority during a state of emergency is making its way through the General Assembly. House Bill 2014, sponsored by Del. Shannon Kimes, R-Wood, seeks to establish legislative oversight of emergency spending provided to the state by the federal government. It would cap the governor’s spending ability to $150 million until the Legislature appropriates the money.

PENNSYLVANIA

Pennsylvania health officials and medical providers agree that about 200,000 doses of the COVID-19 vaccine that were intended to be held back as second doses for those who’d already received the first shot were instead given out as initial doses. Where they appear to disagree is on who is at fault. “We are not here to have blame placed anywhere,” Secretary of Health Alison Beam said during a news conference. But Penn State Health said its use of intended second doses as first doses was done at the direction of the state health department.

NEW YORK

The political whirlwind around New York state’s evasiveness on the number of COVID-19 deaths tied to nursing homes escalated dramatically as Gov. Andrew Cuomo found himself trading accusations of dishonesty with a member of his own party, Assemblyman Ron Kim of Queens. Meanwhile, investigations over the state’s failure to release the statistics have been launched by federal prosecutors and the FBI as New York Republicans continue to call for Cuomo to resign or be impeached. Cuomo has been combative and outraged at the continued attention to the topic, insisting that there’s “nothing to investigate.”

NEW HAMPSHIRE

A bill the aims to dramatically expand school-choice funding in New Hampshire will be put on the shelf for the time being after lawmakers voted to delay any further consideration for the next year. In a 20-0 vote, the New Hampshire House Education Committee opted to hold off advancing legislation to create education savings accounts in the Granite State. The proposal would authorize annual grants of up to $4,597 per student.

MICHIGAN

Since becoming a right-to-work state in 2013, Michigan labor unions have repeatedly violated workers’ rights. On Feb. 12, the National Labor Relations Board in Washington granted the petition of Michigan construction employees to defend their right to vote union bargaining representatives from the workplace. The NLRB decision overturned a November ruling by the Detroit NLRB, which dismissed two petitions filed by Rieth-Riley Construction Company employee Rayalan Kent and coworkers in which they requested a decertification vote against the International Union of Operating Engineers Local 324.

The Michigan Bureau of Elections released a list of approximately 177,000 voter registrations slated for cancelation because the state believed the voter moved away from the registration address because they either surrendered a Michigan Driver’s License or had election mail returned undeliverable before the November 2018 election. In June, conservative activist Anthony Daunt sued Secretary of State Jocelyn Benson and Director of Elections Jonathan Brater, alleging inadequate voter registration list maintenance.

IOWA

Iowa legislators are considering a pair of bills that would add protections for public school employees who safeguard the freedom of expression of students, including journalism advisers of students producing school newspapers. HF 509 was introduced Feb. 15 and referred to the Labor committee, while SF 238 was introduced Feb. 3 and referred to the Education committee, which met about the bill Feb. 8.

MINNESOTA

Gov. Tim Walz asked for President Joe Biden's continued support for the biofuels program last week, despite economists' concerns over concerns about biofuels' inefficiency and costs. Biofuels – bioethanol and biodiesel derived from plants – shave been pitched since 2005 as a solution to climate change because they decrease dependency on fossil fuels. But there are dispersed nationwide taxpayer costs and concentrated benefits to select corn-growing states that profit from biofuels despite higher opportunity costs, Hillsdale College Economics and Public Policy Professor Gary Wolfram said.

WISCONSIN

Wisconsin’s largest business group, Wisconsin Manufacturers & Commerce, said Gov. Tony Evers’ suggestion to allow communities with more than 30,000 people to raise their local sales tax will make many parts of the state less affordable. Wisconsin’s sales tax is a flat 5%. The governor’s office said 68 of 72 counties have imposed another 0.5% local sales tax on top of that. The special 0.1% sales tax that paid for Miller Park expired in April, rolling back taxes in Milwaukee, Ozaukee, Washington, Waukesha, Racine, and Kenosha counties.

Managing editors Delphine Luneau and Jason Schaumburg and regional editors J.D. Davidson, Derek Draplin, Cole Lauterbach, Brett Rowland and Bruce Walker contributed to this column.