Global Monitor (August 2008)

Australia considers seabed sequestration legislation

If the Australian Parliament passes legislation that was introduced by the minister of resources and energy in mid-June, the country could have the world’s first legislative framework for storing carbon dioxide (CO2) offshore, in subsea geological formations.

Australia, the fourth-largest producer of coal in the world, is currently under considerable pressure to find ways to sustain coal-fired power generation—which provides 83% of the country’s electricity—while responding to climate change concerns. One way to do this is to implement policies that aid the development of carbon capture and storage (CCS) technologies, Resources Minister Martin Ferguson said.

“As the world’s largest coal exporting nation it is in our economic interest to accelerate the development of technologies which extend the viability of coal-fired electricity generation,” he said. As well as helping to avoid emissions, CCS would also be crucial to the sustainability of potential new industries such as coal-to-liquids, which could significantly improve Australia’s liquid transport fuel security, he said.

Ferguson said that Geoscience Australia, a national research agency, had already identified several potential storage sites in Victoria, Western Australia, and southern and central Queensland—areas that all have high carbon emissions. The identified formations in offshore waters “have the potential to securely store hundreds of millions of tonnes of carbon dioxide for many thousands of years,” he said. Ferguson added that geological formations that have stored oil and gas—and in some cases CO2—for millions of years are the same as, or similar to, the formations proposed for greenhouse gas storage.

The legislation has already been referred to the House of Representatives Primary Industries and Resources Committee for inquiry and report. If all goes as Ferguson expects, the government could invite proposals for CCS in the continent’s seabed as early as December—a key step that would encourage investment in and commercialization of seabed sequestration technology.

Australia already leads efforts in the Southern Hemisphere to store CO2 on land. In July, the CO2CRC Otway Project announced it had successfully stored 10,000 tons of the gas 1.2 miles underground at a depleted natural gas reservoir in southwestern Victoria. The project’s chief executive confirmed that geosequestration subsurface monitoring showed the CO2 was behaving just as researchers had predicted. The group will now attempt to store another 10,000 tons underground, he said.

To put the storage capacity of these “pilot projects” in perspective: A typical modern 600-MW pulverized coal plant running at 80% capacity factor will produce just under four million tons of CO2 a year—enough to top off the pilot reservoir in less than a day.

As well as conducting its own research, the country has been monitoring several seabed storage projects that are operational or are being planned around the world. Such international efforts were given a boost by a recent amendment to a 1996 Protocol to the Convention on the Prevention of Marine Pollution by Dumping of Wastes and Other Matter, which now exempts CO2 streams. As of February 2007, carbon storage under the seabed has been allowed, and contracting parties to the protocol have been working out new international guidelines on how to safely store CO2 in sub-seabed geological formations in a manner that meets the protocol’s requirements.

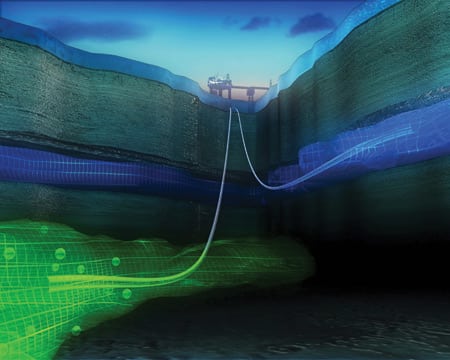

One of the world’s most celebrated CO2 projects is StatoilHydro’s Sleipner field, a large-scale experiment offshore in Norway, where more than 1 million tonnes of CO2 have been injected into a saline aquifer located 2,600 feet below the seabed since 1996 (Figure 1). StatoilHydro removes natural gas and condensate from the Heimdal sandstone formation some 8,200 feet below sea level. Using an amine process, it separates the CO2 from the natural gas in a floating 65-foot-tall, 8,000-ton treatment plant and then injects it into the 650-foot-thick Utsira sandstone formation (above the Heimdal formation, to avoid contamination of the gas field), which is capable of holding 600 billion tonnes of CO2 by some estimates. The Sleipner project also includes a research and monitoring program to examine long-term storage, migration, and leakage.

1. Many leagues under the sea. An artist’s rendition of StatoilHydro’s Sleipner project, a large-scale subsea CO2 sequestration experiment in the Norwegian sector of the North Sea. Carbon dioxide is separated from the natural gas production stream (indicated in green) and reinjected into a saline reservoir 2,600 feet below sea level (shown here as blue). Courtesy: Alligator film /BUG / StatoilHydro

But even with Statoil’s success at Sleipner field (the Norwegian government introduced a $60 per metric ton carbon tax in 1991 to spur interest in CO2 injection), Norway has yet to implement a clear regulatory framework concerning carbon capture—beyond the carbon tax. And unlike Australia, other countries prefer to generate commercial interest in CCS—although not necessarily subsea sequestration—before taking that step.

In July, for example, the UK shortlisted four of nine contenders that had entered a CCS demonstration competition to win $2 billion in government funding. Among the snubbed was a $60 billion scheme to capture two-thirds of carbon emissions from 18 Yorkshire power stations and industrial sites and store them under the North Sea. The project—a collaboration between several companies, including Yorkshire Forward, Corus, Scottish and Southern Energy, Powerfuel Power Ltd., BP, ConocoPhillips, E.ON UK, Shell, and Drax Power—could still rally private investment to become a reality, project members hope.

ElectraTherm installs its first commercial waste-heat generator

A 2007 McKinsey Global Institute study estimated that more than $50 billion in energy savings were possible by adopting combined heat and power (CHP) technologies. Doing so could even cut U.S. fossil fuel use by nearly 20%, according to a Lawrence Berkeley National Laboratory study.

It is no wonder, then, that several emerging U.S. companies and research institutions have launched ventures to recover waste heat and convert it into electricity by means other than CHP. Clean technology firm ElectraTherm Inc. in late May, for example, announced that testing of a commercial waste heat power generator at Southern Methodist University in Dallas, Texas, had exceeded expectations, reaching output well beyond its 50-kW rating.

Dubbed the “Green Machine” (Figure 2), the device uses a closed-loop organic Rankine cycle (ORC) whose turbo-expanders have been replaced with a patented twin-screw expander. Surplus heat as low as 200F (liquid) is captured by the Green Machine’s evaporator, where it “boils” a chemical working fluid into vapor. Under pressure, the vapor is forced through the company’s twin-screw expander, turning it to spin a generator. The vapor is then condensed, again pumped to higher pressure, and returned to the evaporator to repeat the process.

2. Junk energy. ElectraTherm Inc. successfully tested a commercial waste heat generator at Southern Methodist University in May. The “Green Machine” produced more than 50 kW using heat as low as 200F to run a closed-loop organic Rankine cycle (ORC). To make it cost-effective, the ORC was fitted with a patented twin-screw expander instead of typical turbo-expanders. Courtesy: ElectraTherm Inc.

Because the twin-screw expander is simpler to manufacture than turbo-expanders, the Nevada-based company estimates that its machine will cost 30% less than a turbine ORC system and pay for itself, “subsidy-free,” in three years. More important, once the initial investment is paid off, ElectraTherm expects that the Green Machine could produce power at 1 cent per kWh (its current output costs 3 to 4 cents per kWh).

Mass. researchers achieve dramatic increase in thermoelectric efficiency

Cost-effectiveness had been a key goal for researchers at Boston College and the Massachusetts Institute of Technology who announced in March that they have used nanotechnology to achieve a major increase in the thermoelectric efficiency of a bulk semiconductor alloy.

The team’s low-cost approach, details of which are published in the online version of the journal Science, involves building tiny alloy nanostructures that can serve as micro-coolers and power generators. The researchers said that in addition to being inexpensive, their method will likely result in practical, near-term enhancements to make products consume less energy or capture energy that would otherwise be wasted.

The scientists were looking to recreate a common and low-cost material—bismuth antimony telluride—to conduct electricity but not heat. They achieved 40% of the semiconductor alloy’s thermal conduction by crushing the alloy into nanoscopic dust and then reconstituting it in bulk form, albeit with nanoscale constituents (Figure 3). The grains and irregularities of the reconstituted alloy dramatically slowed the passage of phonons (a quantum mode of vibration) through the material, radically transforming the thermoelectric performance by blocking heat flow while allowing electrical flow.

3. Current but no heat? Researchers produced a major increase in thermoelectric efficiency after using nanotechnology to restructure bismuth antimony telluride, a semiconductor alloy commonly used in industry and research. Viewed through a transmission electron microscope, colors highlight each nano-crystalline grain. Courtesy: Boston College, MIT, and GMZ Inc.

The achievement marks the first such gain in a half-century using a cost-effective material that functions at room temperatures and up to 482F.

At its core, thermoelectricity is the “hot and cool” issue of physics. Heating one end of a wire, for example, causes electrons to move to the cooler end, producing an electric current. In reverse, applying a current to the same wire will carry heat away from a hot section to a cool section. Phonons play a key role because they are the primary means by which heat conduction takes place in insulating solids.

Thermoelectric materials have been used by NASA to generate power for spacecraft. These materials also have been used by specialty automobile seat makers to keep drivers cool during the summer. The auto industry has been experimenting with ways to use thermoelectric materials to convert waste heat from a car exhaust system into electric current to help power the vehicle.

This research will be particularly influential in the development of solar energy technologies, as the conversion of solar heat into electricity is currently limited by materials that are less thermoelectrically efficient and more expensive.

Nuclear power option for developing nations gaining steam

By 2030 global energy demand is predicted to be 40% higher than it is today, and almost three-quarters of that demand will come from developing countries, the International Energy Agency reports. While the world scrambles to draw up plans for mega-dams and massive wind farms to meet this demand, an international team has been designing nuclear reactors that are cost-effective and a better fit for developing nations than traditional utility-scale plants.

Widely known as grid-appropriate reactors, they are smaller in size than the giants installed in developed countries. Compared to current light-water reactors that can generate up to 1,600 MW, grid-appropriate reactors are designed to put out between 250 MW and 500 MW—a substantial load for nations with smaller power grids and less-developed technical infrastructures. Grid-appropriate reactors can also be built in just over half the time required to construct a large nuclear power plant. With a staggered build strategy, two or more reactors can be set up in a series, which reduces up-front capital costs and can potentially result in quicker return on investment.

In developed nations, the effort to commercialize grid-appropriate reactors could lead to specialized uses for nuclear reactors such as an independent power source for military bases, biofuel production, coal-to-liquid conversion, and economical oil shale and tar sand recovery. For example, Russia is constructing a floating nuclear power plant slated for launch by 2010 capable of producing enough electricity to power a city of 200,000 and desalinate 60 million gallons a day in remote arctic regions. Utilities in many parts of the U.S. may also look to smaller reactors to supplement their power generation needs as demand for energy rises.

For all these reasons, the Global Nuclear Energy Partnership (GNEP) is convinced that grid-appropriate reactors are the keystone in the global expansion of nuclear energy—and it recently launched a campaign to make these reactors commercially available.

In 2008, members of the grid-appropriate reactor team will develop a solicitation for a public-private partnership to select a U.S.-based light-water reactor design for safety and licensing support beginning in fiscal year 2009. The campaign aims to speed the development, demonstration, and deployment of grid-appropriate reactors and have the first reactor ready for construction as early as 2015.

The partnership cites a specific Generation IV reactor: the International Reactor Innovative and Secure (IRIS), which is being developed through an international partnership for deployment by 2015 (see POWER, April 2008, “Developing the next generation of reactors”).

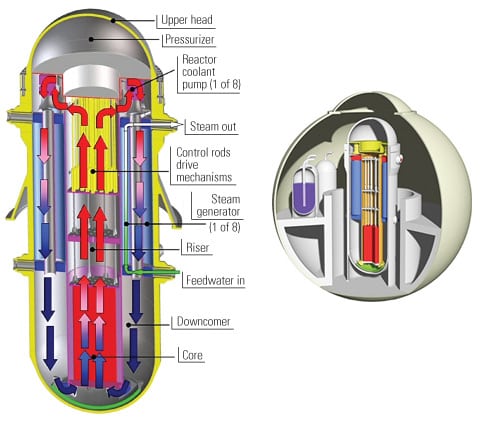

The IRIS design basically consists of an integrated primary system that incorporates all main primary circuit components within a single vessel. These include the core with control rods and their drive mechanisms, eight helical coil steam generators with eight associated fully immersed axial flow pumps, and a pressurizer (Figure 4).

4. Mini-reactor. An international coalition of companies and research institutions is developing a Generation IV small-scale light-water reactor, the IRIS, and anticipate its deployment by 2015. The reactor’s components are similar to those of an integrated primary system. Source: GNEP

According to the project’s web site, the partnership is currently wrapping up necessary testing for Nuclear Regulatory Commission (NRC) design certification. Final design approval is expected by 2012.

Comprising 20 organizations from 10 countries, the IRIS partnership includes nuclear powerhouses like Westinghouse and UK-based BNFL; laboratories from the U.S., Brazil, Italy, Mexico, and Lithuania; and several universities. Westinghouse is tasked with coordinating the effort, leading the core design, conducting safety analyses, and leading the reactor through licensing and commercialization.

Members of the grid-appropriate reactor team expect that over the next five years, the U.S. Department of Energy will cost-share about 20% of the estimated $500,000 effort to achieve design certification by the NRC.

The great green wall of China

Since winning the bid in 2001 for the Olympic Games in Beijing this summer, China has sought to make over its image of heavyweight industrial pollutant to one of environmentally responsible, clean energy supporter. Beijing, a city with a population of 17.4 million, has implemented 20 costly projects over the past three years to clean up the smog and improve air quality, from installing desulfurization systems at most power generating units to restricting an estimated 3.5 million vehicles from driving on the city’s roads on certain days.

The nation that builds about two coal plants per week and already leads the world in carbon emissions by some estimates is so committed to presenting a sustainable face to the rest of the world this August, it has declared it will conduct a “Green Olympics”—promising zero net emissions associated with hosting the games. To some extent this campaign has paid off: China’s drive to “strengthen public awareness of environmental protection and promote the development and application of new technologies” has yielded some enviable results.

Among them is a groundbreaking project featuring one of the world’s largest color LED displays and the first photovoltaic (PV) system integrated into a glass curtain wall at Xicui Entertainment Complex, a site close to the Olympic Games in Beijing. The zero-energy media wall, dubbed “GreenPix” by designers Simone Giostra & Partners Architects, transforms the building envelop into a self-sufficient organic system, harvesting solar energy by day and using it to illuminate the screen after dark, mirroring a day’s solar cycle (Figure 5).

5. A green facade. A team of engineers, designers, and architects recently installed GreenPix, a zero-carbon LED display and photovoltaic system integrated into a glass curtain wall in Beijing, just in time for the summer Olympics. Courtesy: Simone Giostra & Partners Architects

Giostra and British engineering firm Arup developed a new technology with the support of leading German PV manufacturers Schueco and SunWays to laminate polycrystalline PV cells in a glass curtain wall. The cells are placed with changing density on the entire building’s skin. The density pattern increases the building’s performance, allowing natural light to permeate the building envelope when required inside while at the same time reducing heat gain and transforming excessive solar radiation into energy for the media wall.

Architect Simone Giostra anticipates that GreenPix’s display, composed of 2,292 color (RGB) LED light points—comparable to a 24,000-square-foot monitor for dynamic content display—will provide Beijing with a unique communication surface devoted to unprecedented forms of digital art. Though this is likely, the project is more significant because it promotes an uncompromised integration of sustainable technology in architecture. It is a successful—"radical,” even, as Giostra calls it—example of an emerging solar energy technology worldwide: building-integrated photovoltaics (BIPV).

Basically defined, BIPVs are PV materials serving as exterior structural building components, such as roofing, facade, or skylights. These materials can be installed during actual construction or retrofitted, and they are used typically for on-grid application rather than off-grid microgeneration.

Because the technology provides versatility and life-cycle savings, the BIPV sector is growing in popularity. Last year it had a worldwide growth spurt of 33% compared to 2006, says UK growth partnership company Frost & Sullivan. BIPV has also benefited from overwhelming political support in Europe, where the EU endorses the technology. Its major challenge continues to be affordability; in Europe, even with the help of EU subsidies and tax incentives that have lowered prices, it continues to be expensive.

When cost is not an issue, the technology becomes an architectural component. The OpTIC project in Wales and Stillwell Avenue Station in New York are modern examples of BIPV—although neither is as grand as the GreenPix in Beijing.

POWER digest

News items of interest to power industry professionals.

Basin Electric and Powerspan Corp. complete CCS feasibility study. A feasibility study for a project to add carbon capture controls at Basin Electric Power Cooperative’s 900-MW coal-fired Antelope Valley Station (AVS) in North Dakota has been completed with positive results, Basin Electric and project partner Powerspan Corp. have announced. (See the “R.E. Burger Plant” Top Plant story in POWER, October 2007, for details on the Powerspan CO2 removal technology.)

The project to demonstrate the commercial viability of CO2 capture in conventional coal-fired power plants was announced earlier this year by Bismarck-based Basin Electric and Powerspan, a clean-energy technology company.

It will use a postcombustion and regenerative CO2 capture process developed by Powerspan to capture about 1 million tons, or 90%, of CO2, from a select 120-MW slipstream at AVS’s Unit 1. The captured CO2 would then be delivered by pipe to an existing compressor station at the adjacent Synfuels Plant and then injected into a 205-mile pipeline system owned by Basin Electric subsidiary Dakota Gasification Co., which is the only U.S. company that currently captures CO2 and delivers it for oil-recovery purposes to oil producers.

Basin Electric and Powerspan now plan to conduct a front-end engineering and design study. Construction of the system is scheduled to move forward late next year. The project is expected to be operational in 2012.

If the project succeeds, it could be the first U.S. commercial-scale application of its kind, and one of the largest in the world, the companies said. However, the $200 million to $300 million demonstration will require federal support to ensure success, said Ron Harper, Basin Electric CEO and general manager.

“If we’re going to revolutionize the way coal is used in the future, it’s imperative that the federal government help meet this challenge and share in the risk. We’re working closely with North Dakota’s congressional delegation and Gov. Hoeven and we look forward to continued work in this arena,” Harper said.

Powerspan’s ECO2 process uses an ammonia-based solution to capture flue gas CO2 as a final step, after other emissions—of sulfur dioxide, mercury, and fine particulate matter—are captured.

Once the CO2 is captured, the ammonia-based solution is regenerated to release CO2 and ammonia. The ammonia is recovered and sent back to the scrubbing process, and the CO2 is in a form that is ready for geological storage. Ammonia is not consumed in the scrubbing process, and no separate by-product is created.

Unlike other carbon capture approaches, Powerspan’s uses a simpler equipment design and significantly less energy, a company statement said. The technology is suitable for retrofitting to the existing coal-based electric generating fleet as well as for new coal-fired plants.

Alstom to build major plants in Saudi Arabia, Tunisia. In June, Alstom signed a letter of intent with Saudi Arabian utility Saudi Electricity Co. (SEC) for a $3 billion turnkey contract to build a new three-unit 1,200-MW steam power plant in Saudi Arabia.

The plant will be constructed adjacent to the existing Shoaiba power station, 62 miles south of Jeddah. Upon completion, the Shoaiba power plant will comprise 14 units of 400 MW each, bringing its total output to 5,600 MW. The contract will be finalized in the coming months, Alstom said.

The agreement marks the third stage of the Shoaiba project. The previous 11 units were supplied by an Alstom-led consortium on a turnkey basis under two separate contracts won in November 1998 and January 2004 respectively.

Under this contract, Alstom will design, supply, install, and commission the entire plant, including boilers, STF40 steam turbines, Gigatop 2-pole turbogenerators, seawater flue gas desulfurization systems for removal of SO2, and the complete balance-of-plant systems for the three units. Alstom’s consortium partner, Saudi Archirodon, will carry out all the associated civil work.

The boilers are designed to burn both crude and heavy fuel oil and will use Alstom’s advanced low-NOx tangential firing technology. Delivery of major equipment is scheduled in 2010.

Electric power demand in Saudi Arabia is growing at around 7% each year, requiring massive investment in the country’s power generation capacity, Alstom said.

In a separate statement, Alstom said in July it had won a $660 million turnkey contract from Societe Tunisienne de l’Electricite et du Gaz (STEG), the utility that provides about 80% of Tunisia’s power. Alstom will build a 400-MW combined-cycle power plant at Ghannouch, in the Gabes region, southern Tunisia. An additional contract includes a 12-year operation support and maintenance agreement.

Under the terms of this contract, Alstom will supply a fully integrated turnkey power plant, composed of one KA26 combined-cycle unit consisting of one GT26 gas turbine, one heat-recovery steam generator, one steam turbine, one TOPGAS turbogenerator, and the ALSPA distributed control system.

Ghannouch will be the third power plant constructed by Alstom for STEG in Tunisia, after the combined-cycle power plants of Sousse and Rades, which went on-line in 1994 and 2001 respectively. Tunisia’s demand for power rises by 6% annually as a result of that country’s rapid economic development.

Alstom plans to build the new facility on the site of the old thermal power plant at Ghannouch to allow use of existing facilities such as the seawater intake and discharge structures. The company expects the plant will meet a major part of the electricity demand in the southern part of the country and maintain the equilibrium of electric power production among the regions.

Mitsubishi to deliver BFG-GTCC plants in China and Korea. Mitsubishi Heavy Industries Ltd. in June received consecutive orders for blast furnace gas (BFG)-fired gas turbine combined-cycle (GTCC) power generation plants from China and Korea.

The equipment for a 150-MW BFG-GTCC power plant for Qian’an Iron and Steel Works, part of the Chinese steelmaker Shougang Group, is slated for delivery in May 2009.

The equipment for two 142-MW plants of the same kind—248 MW in total—is for POSCO Power Corp., the largest independent power producer in Korea, and is scheduled for delivery in 2009 and 2010. POSCO Power is building the power plants at Gwangyang Works of POSCO, Korea’s largest steel company, headquartered in Pohang.

Foster Wheeler Spanish subsidiary wins multiple HRSG projects. Foster Wheeler Ltd. said in June that its Spanish subsidiary Foster Wheeler Energia, S.A., has been awarded three contracts for heat-recovery steam generators (HRSGs) in Portugal, Spain, and the Netherlands. The company has received a full notice to proceed on all contracts. Terms of the awards were not disclosed.

The Portuguese consortium MECI-Somague awarded Foster Wheeler a contract for the design and supply of two HRSGs to be coupled with General Electric’s LM-2500 combustion turbines in a cogeneration power plant that MECI-Somague will build at the Portucel Soporcel manufacturing complex in Setubal, Portugal. The HRSGs are scheduled for delivery during the fourth quarter of 2008.

The Spanish company CEPSA awarded Foster Wheeler a contract for the design, supply, and erection of an HRSG and auxiliary equipment, which will be integrated in a cogeneration plant to be built at the La Rabida Refinery in Huelva, Spain. The HRSG will be coupled with a General Electric 6FA gas turbine. Commercial operation is scheduled for the first quarter of 2010.

The Spanish joint venture Abener Inabensa Paises Bajos, S.A. also awarded Foster Wheeler a contract for the design and supply of an HRSG and auxiliary equipment, as well as erection and commissioning advisory services. That HRSG will be integrated in a bio-ethanol plant to be built at the Rotterdam Europoort in the Netherlands. Delivery is scheduled for the second quarter of 2009.

MAN Diesel wins major plant contract in Pakistan. German diesel engine manufacturer, MAN Diesel SE has signed a contract covering the supply of all the equipment for a second large diesel engine power station in Pakistan.

The company stated that its contract with Hub Power Co., an independent power provider, is worth around $23.5 million and involves the construction on a turnkey basis of a plant that will produce over 200 MW of electrical power at Narowal in the Lahore region.

MAN Diesel’s local subsidiary in Pakistan, MAN Diesel (pvt) Ltd., will be responsible for the supply of local goods and services, the company said. The Narowal plant will by powered by 11 of the largest 18-cylinder “vee” configuration versions of the most powerful four-stroke engine in MAN Diesel’s stationary power generation program, type 48/60B.

The engines will burn heavy fuel oil and will operate in a 213.6-MW diesel/combined-cycle arrangement. Heat-recovery steam generators on each of the 11 engine-generator sets produce steam to power a single steam turbine.

The plant is due to go on-line at the end of March 2010. MAN Diesel’s first contract with a Pakistani plant, a 225-MW facility at Sheikhupura, also near Lahore, is scheduled to start a year earlier.

—Compiled by Sonal Patel.

Correction

On page 11 of the May issue of POWER the output for South Texas-1 should have been 12.36 million MWh.

POWER regrets the error.